By Rinki Pandey September 9, 2025

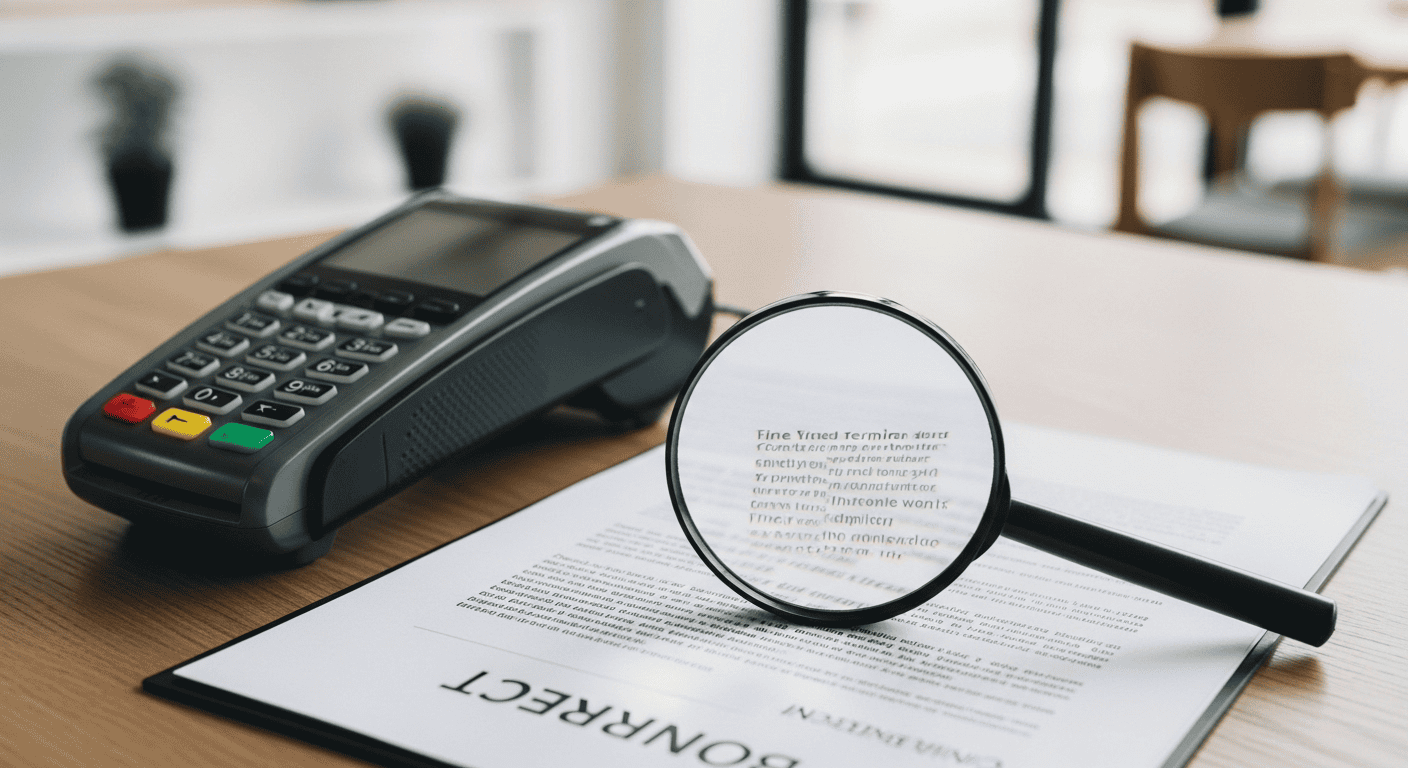

Free terminal merchant services The word “free” is one of the most powerful in marketing. For a new or growing business, the offer of a free piece of essential equipment, like a credit card terminal, can seem like an incredible opportunity to save on startup costs. Merchant service providers know this, and the allure of free terminal merchant services is a common tactic used to attract new clients. But is it truly free? Or is it a classic case of “if it sounds too good to be true, it probably is”?

This comprehensive guide will pull back the curtain on these popular offers. We will dive deep into the fine print, uncover the hidden costs, and explore what “free” really means in the world of payment processing. By the end, you will understand the mechanics behind free terminal merchant services, be able to identify when it might be a good deal, and know exactly how to qualify and negotiate the best possible terms for your business. Making an informed decision starts with understanding the complete picture, not just the appealing headline.

What Exactly Are Free Terminal Merchant Services?

Before you can evaluate an offer, you need to understand what is actually being presented. The term “free terminal” is not a standardized industry offering; it’s a marketing umbrella that covers several different types of arrangements. Navigating the world of free terminal merchant services requires a clear understanding of these distinctions.

Defining the “Free” in Your Payment Processing

At its core, a free terminal offer is a strategy used by a Payment processor or merchant services provider (MSP) to eliminate the upfront hardware cost for a business in exchange for a processing agreement. The provider is betting that they will recoup the cost of the terminal, and then some, through the fees you pay to process credit and debit card transactions over the life of your contract.

The terminal itself is not a gift with no strings attached. It is an incentive, a tool to lock you into a partnership. The provider is essentially subsidizing your hardware cost to secure your long-term processing business. Therefore, the value and true cost of the offer are not in the terminal itself but hidden within the terms, rates, and fees of the accompanying merchant agreement. The promise of free terminal merchant services is the hook that gets you to sign on the dotted line.

The Different Flavors of “Free”: Unpacking the Offers

Not all “free” deals are created equal. When a provider advertises free terminal merchant services, they are typically referring to one of the following arrangements. Understanding which model is being offered is the first step in analyzing the deal.

- The Free Placement or Loaner Program: This is the most common type of offer. The provider “places” a terminal in your business for you to use as long as you process payments with them. You never actually own the equipment. It is, for all intents and purposes, a long-term loan. If you switch providers, you must return the terminal, often in its original box and in perfect condition.

- The “Free After Rebate” Model: In this scenario, you initially purchase the terminal. After you have processed a certain volume of transactions or have been a client for a specific period, the provider issues a rebate or a statement credit for the full purchase price of the hardware. This model ensures the provider gets some commitment from you before they cover the cost.

- The Leased Terminal: While often marketed deceptively alongside “free” offers, a lease is the most expensive way to acquire a terminal. You sign a non-cancellable, multi-year lease agreement, often with a third-party leasing company, and make monthly payments that will far exceed the actual retail value of the machine over the lease term. This is a model to be extremely wary of and is fundamentally different from legitimate free terminal merchant services.

- The “Free” Terminal Bundled with a Software Package: Some modern point-of-sale (POS) systems will bundle the hardware with their monthly software subscription. You might receive a card reader or a basic terminal at no upfront cost, but its use is tied to your ongoing software subscription, which is where the provider makes their money.

The Hidden Costs: Decoding the Fine Print of Free Terminal Merchant Services

The true cost of a “free” terminal is never zero. It is simply shifted from an upfront hardware expense into other areas of your merchant services agreement. To protect your business’s bottom line, you must become an expert at reading the fine print and identifying these hidden costs before you commit. This is where the initial savings from free terminal merchant services can quickly evaporate.

Higher Processing Rates and Fees

This is the most common way providers recoup the cost of the hardware. A provider might offer you a “free” terminal but set your processing rates slightly higher than a competitor who requires you to purchase the equipment. While a fraction of a percent may seem insignificant, it adds up to a substantial amount over thousands of transactions and several years.

These offers are often paired with less transparent pricing models, like Tiered or Bundled pricing. In these structures, the provider groups hundreds of different interchange rates into a few “tiers” (e.g., Qualified, Mid-Qualified, Non-Qualified). They can manipulate which transactions fall into which tier, often pushing more of your sales into the higher-cost tiers, making your effective rate much higher than advertised. The transparency of an Interchange-Plus pricing model is rarely offered with the best free terminal merchant services deals.

Long-Term, Ironclad Contracts

A free terminal is almost always a trade-off for a long-term commitment. Most free terminal merchant services agreements come with a contract term of three to four years. This contract will include an automatic renewal clause, which means if you don’t provide written notice of your intent to cancel (often 60-90 days before the expiration date), the contract automatically renews for another term, usually one year.

The real danger lies in the Early Termination Fee (ETF). If you become unhappy with the service or find a better deal elsewhere and wish to leave before your contract is up, you will be hit with a significant penalty. This fee can be a flat rate of several hundred dollars or, in the worst-case scenario, a “liquidated damages” clause. This means you would owe the provider the full amount of profit they projected to make from your account for the remainder of the contract term, a sum that could easily run into thousands of dollars.

Non-Return Fees and Equipment Liability

Since you don’t own the terminal in a free placement program, you are liable for its condition. The contract will stipulate that the equipment must be returned in “good working condition” upon termination of the agreement. If the terminal is lost, stolen, or damaged beyond normal wear and tear, you will be charged a non-return fee, which is often the full, inflated retail price of the machine.

You are also responsible for returning it promptly, sometimes within 10-15 business days of closing your account. Failure to do so will trigger the non-return fee. This clause protects the provider’s asset and is a critical component of the agreement for free terminal merchant services.

PCI Compliance and Other Monthly Fees

The “free” part of the offer only ever applies to the physical terminal. It does not absolve you of the myriad of other fees associated with a merchant account. You should still expect to see several charges on your monthly statement, including:

- PCI Compliance Fee: A fee charged for ensuring your business meets the Payment Card Industry Data Security Standard. This can be a monthly or annual charge.

- Statement Fee: A monthly fee for the creation and delivery of your processing statement.

- Monthly Minimum Fee: If your processing fees for a given month do not meet a certain threshold (e.g., $25), the provider will charge you the difference.

- Gateway Fee: If you process transactions online, you will likely pay a monthly fee for the payment gateway.

These fees are standard, but they underscore the fact that even with free terminal merchant services, there is no such thing as a completely free merchant account.

Limited Technology and Upgrades

To maximize their profit margins, providers often use older or refurbished terminal models for their free placement programs. While these machines will be functional and compliant, they may lack the latest features like contactless NFC payments, faster processing speeds, or advanced Wi-Fi capabilities.

Furthermore, your contract may not include provisions for technology upgrades. As payment technology evolves, your “free” terminal could become outdated, potentially slowing down your checkout process or preventing you from accepting new forms of payment. Upgrading to a newer model might require you to sign a new, extended contract or pay for the new hardware out of pocket, negating the initial “free” benefit. Finding high-quality free terminal merchant services often means asking specific questions about the age and model of the equipment being offered

Is a “Free” Terminal Ever a Good Deal? Identifying the Right Scenarios

After exploring all the potential pitfalls, it’s easy to conclude that free terminal merchant services are always a bad deal. However, that’s not necessarily the case. For certain types of businesses in specific situations, a free terminal offer can be a strategic and beneficial choice, provided it is approached with caution and full awareness of the terms.

When Free Terminal Merchant Services Make Sense for Your Business

A free terminal program can be the right move under the following circumstances:

- For New Businesses with Limited Capital: Startups often operate on a shoestring budget. A brand-new, top-of-the-line terminal can cost anywhere from $300 to $800. A free terminal offer eliminates this significant upfront expense, allowing a new business to allocate that capital to other critical areas like inventory, marketing, or rent.

- For Very Low-Volume Merchants: If your business only processes a handful of credit card transactions each month, the potential savings from a slightly lower processing rate might be negligible. The convenience of avoiding an upfront hardware cost could outweigh the minor difference in long-term processing fees.

- For Businesses Seeking Simplicity: For some business owners, the “all-in-one” nature of a free terminal deal is appealing. They receive the hardware and processing from a single source and don’t have to worry about compatibility or setup issues. This simplicity can be valuable for those who are not tech-savvy.

The key is to do the math. Calculate your projected processing volume and compare the total cost of a free terminal merchant services offer (with its potentially higher rates) over the contract term against the cost of buying a terminal and securing a lower processing rate.

The Alternative: The Benefits of Buying Your Own Terminal

For many businesses, particularly those with established or growing sales volume, purchasing a credit card terminal outright is the more financially sound decision in the long run. This approach offers several distinct advantages over relying on free terminal merchant services.

- Freedom and Flexibility: When you own your equipment, you are not tied to any single payment processor. If you find a provider offering better rates or superior customer service, you can switch without penalty. Most modern terminals are “unlocked” and can be reprogrammed by your new provider.

- Lower Long-Term Costs: The upfront cost of buying a terminal is often recouped within the first year through the savings you gain from a more competitive processing rate. Because the provider doesn’t need to subsidize your hardware, they are more willing to offer you a lower-cost Interchange-Plus pricing plan.

- Access to the Latest Technology: Purchasing your own terminal means you can choose the exact model that fits your business needs. You can select a machine with the fastest processing, the most robust connectivity options (Ethernet, Wi-Fi, 4G), and the latest payment acceptance technologies like tap-to-pay and QR code scanning.

- No Long-Term Contracts: While you will still have a processing agreement, it’s often on a month-to-month basis when you bring your own equipment. This gives you the ultimate power and flexibility to ensure your provider continues to earn your business every single month.

How to Qualify and Secure the Best Deal on Free Terminal Merchant Services

If you’ve weighed the pros and cons and decided that a free terminal offer is the right path for your business, your next step is to navigate the process strategically. You want to ensure you not only get approved but also secure the most favorable terms possible. This involves understanding the provider’s criteria and being prepared to ask tough questions and negotiate.

Understanding the Application and Approval Process

Qualifying for a merchant account, including one with a free terminal, involves a risk assessment by the provider. They are essentially underwriting your business to gauge the likelihood of chargebacks and fraud. The process typically includes:

- A Detailed Application: You’ll need to provide information about your business, including its legal name, tax ID number, business address, and details about the products or services you sell.

- A Personal Credit Check: The provider will run a credit check on the business owner(s). A strong personal credit score is often a key factor in getting approved, especially for new businesses without a long history.

- Review of Business History: They will look at your time in business, your industry type (some are considered “high-risk”), and your estimated monthly processing volume. Higher volume can sometimes lead to better terms.

- Bank Account Verification: You will need to provide a voided check or bank letter to link your business bank account for deposits and fee withdrawals.

Being prepared with all this documentation can streamline your application for free terminal merchant services.

Key Questions to Ask Before Signing Any Agreement

This is the most critical stage. Do not let a salesperson rush you. Before you sign anything, you need clear, written answers to the following questions. Their willingness to answer transparently is a good indicator of the kind of partner they will be.

- Rates and Fees: “Can you provide a full, written breakdown of all processing rates and fees? What is the pricing model (Interchange-Plus, Tiered, Flat-Rate)? What are the exact rates for each tier or the exact markup over interchange?”

- Contract Terms: “What is the exact length of the contract in months? Is there an automatic renewal clause? If so, what is the renewal term and what is the required notice period to cancel before renewal?”

- Termination Fees: “What is the penalty for early termination? Is it a flat fee or a liquidated damages clause? Can I see that specific clause in the contract?”

- Equipment Details: “What is the make and model of the terminal? Is it new or refurbished? Do I own the terminal, or is it a placement/loaner? What is the non-return fee if it’s damaged or lost?”

- Support and Service: “What are the hours for customer and technical support? Is support based in my country? Who is responsible for the cost of a replacement if the terminal malfunctions?”

- All Other Fees: “Please list every single monthly, annual, or incidental fee I will be charged, including PCI compliance, statement fees, and monthly minimums.”

Getting these answers in writing is crucial for comparing offers and protecting your business. A good provider of free terminal merchant services will have no problem providing this information.

Negotiating Your Terms Like a Pro

Everything in a merchant agreement is potentially negotiable. The provider wants your business, which gives you leverage.

- Leverage Your Volume: If you have a solid processing history or project high monthly sales, use that as a bargaining chip to ask for a lower rate or a shorter contract term.

- Ask for a Shorter Contract: Push for a two-year contract instead of a three-year, or ask for a no-fee cancellation option after a certain period.

- Request a Waiver: Ask them to waive certain fees, like the application fee or the first year’s annual PCI compliance fee.

- Show You’ve Done Your Homework: Mentioning that you are comparing their offer with others shows that you are a savvy business owner. This can prompt them to put their best offer forward. By demonstrating your knowledge of free terminal merchant services, you signal that you cannot be easily taken advantage of.

Comparing “Free” Terminal Offers: A Detailed Breakdown

To help you visualize the differences between the common types of “free” terminal deals, the table below breaks down the key features, pros, and cons of each arrangement. Use this as a framework to evaluate any free terminal merchant services proposal you receive.

| Feature | Free Placement / Loaner Program | Free Terminal After Rebate | Leased Terminal (Avoid) |

| Ownership | Provider owns the terminal. You must return it upon cancellation. | You own the terminal after the rebate is successfully processed. | The leasing company owns it. You are just renting it. |

| Upfront Cost | $0. No initial cost for the hardware. | The full retail price of the terminal, which is refunded later. | First and last month’s payment. Often includes processing fees. |

| Contract Length | Typically 3-4 years, often with an auto-renewal clause. | Typically 2-3 years, tied to meeting rebate conditions. | A non-cancellable 4-5 year term. Extremely difficult to exit. |

| Key Pro | No capital outlay, which is ideal for new businesses on a tight budget. | You gain ownership of the hardware, providing long-term flexibility. | None. This model provides no benefits to the merchant. |

| Key Con | You are locked into one provider. High ETFs and non-return fees. | Requires an initial cash outlay and meeting specific conditions to get your money back. | Grossly overpriced. You will pay 5-10x the terminal’s value over the lease term. |

| Best For | Startups with zero capital for hardware, fully aware of the contract terms. | Businesses that can afford the upfront cost and want to own their hardware eventually. | No one. This is a predatory model that should always be avoided. |

The Future of Payments: Beyond the Traditional “Free” Terminal

The payment processing landscape is constantly evolving. The traditional countertop terminal is no longer the only option, and the concept of “free” hardware has taken on new forms. Understanding these modern alternatives is essential for making a future-proof decision for your business.

The Rise of Mobile POS (mPOS) Systems

Companies like Square, SumUp, and PayPal Zettle have revolutionized payments for small businesses and mobile vendors. Their model often includes a free or very low-cost initial magstripe or chip card reader that connects to a smartphone or tablet.

Their business model is different from traditional free terminal merchant services. They profit from simple, transparent flat-rate pricing. While this rate may be higher for larger businesses than a negotiated Interchange-Plus plan, it offers simplicity, predictability, and no long-term contracts. For micro-merchants, freelancers, or businesses that only process cards occasionally, this is often a more cost-effective and flexible solution.

All-in-One POS Systems and Software Integration

Modern Point of Sale (POS) systems from providers like Clover, Toast (for restaurants), or Lightspeed go far beyond simple payment acceptance. They are comprehensive business management tools that handle inventory, customer relationship management (CRM), employee scheduling, and detailed sales analytics.

With these systems, the hardware (which can include a terminal, tablet, cash drawer, and receipt printer) is often sold as part of a larger package. The provider might offer the hardware at a discount or with a “free” placement model in exchange for a multi-year subscription to their software. In this context, the cost of the hardware is baked into the monthly software-as-a-service (SaaS) fee. This is a more advanced form of free terminal merchant services, where the “lock-in” is tied to the indispensable software that runs your daily operations.

Conclusion: Making an Empowered Choice

The offer of free terminal merchant services is a powerful marketing tool, but it is never truly “free.” The cost of the hardware is always accounted for, whether through slightly elevated processing rates, long-term contracts with hefty cancellation fees, or other monthly charges.

This does not automatically make these offers a bad choice. For a brand-new business watching every penny, a free terminal program can be a viable and strategic way to get up and running without a large initial investment. The key to success is to approach these deals not as a free gift, but as a complex financial product.

By arming yourself with knowledge, you can transform from a passive recipient of a sales pitch into an active, informed negotiator. Read every line of the contract, ask probing questions, and do the math to calculate the total cost over the life of the agreement. Whether you choose to pursue a free terminal deal or invest in your own equipment, making the decision with your eyes wide open is the most critical step you can take to protect your business and your bottom line. The best free terminal merchant services are not the ones with the flashiest ads, but the ones with the most transparent and fair terms.

Frequently Asked Questions (FAQ)

1. Is a “free terminal” from a merchant services provider really free?

No, it is not truly free. The cost of the hardware is recovered by the provider through other means, such as slightly higher processing fees, long-term contracts, or various monthly and annual fees. The “free” aspect refers only to the lack of an upfront cost for the physical machine.

2. What happens if I want to cancel my contract early with a free terminal?

If you cancel your contract before the term expires, you will almost certainly face an Early Termination Fee (ETF). This can be a flat fee (e.g.,

295−295−595) or a more punitive “liquidated damages” clause, where you owe the provider their projected profits for the remainder of the contract. You will also be required to return the terminal immediately.

3. Can I use a terminal from one provider with a different payment processor?

If you own the terminal (e.g., you bought it or received it through a rebate program), it can usually be reprogrammed for use with another provider. However, if you have a “free placement” or “loaner” terminal, you cannot. That equipment is proprietary to the original provider and must be returned if you switch services.

4. Are the credit card processing rates always higher with free terminal merchant services?

While not a universal rule, it is very common. To offset the cost of the hardware they are providing, providers often build a slightly larger profit margin into their processing rates. This is why it’s essential to compare the total long-term cost, not just the upfront savings on equipment.

5. What is a better alternative to a free terminal deal for a new business?

A strong alternative is to purchase an affordable, unlocked terminal and sign up with a provider that offers transparent Interchange-Plus pricing on a month-to-month contract. While this requires a modest upfront investment (

200−200−400), it provides long-term savings, flexibility, and the freedom to switch providers at any time without penalty. Mobile POS solutions like Square are also excellent, contract-free alternatives for low-volume or mobile businesses.