By Rinki Pandey September 9, 2025

Merchant Services for small business Welcome to the world of small business ownership, where you wear many hats—CEO, marketer, customer service representative, and, of course, accountant. One of the most cryptic documents that lands on your desk each month is the merchant statement. It often feels like a puzzle written in a foreign language, filled with confusing acronyms, perplexing fees, and numbers that don’t always seem to add up.

Many business owners simply glance at the total fee, sigh, and file it away. But within those lines of text lies the key to understanding and controlling one of your most significant operational costs. Ignoring it is like leaving money on the table. This guide is here to change that. We will demystify every section, decode every fee, and empower you to take control of your payment processing costs.

Understanding this document is not just about saving money; it’s about making smarter decisions for your company’s financial health. A clear grasp of your statement is a fundamental component of effectively managing your merchant services for small business. Let’s unravel this puzzle together, turning confusion into confidence, one line item at a time.

Why Understanding Your Merchant Statement is Critical

Before we dive into the nitty-gritty details, it’s essential to grasp why this monthly review is so crucial. Your merchant statement is more than just a bill; it’s a detailed report card on your payment processing health and a roadmap for potential savings. Properly managing your merchant services for small business begins with this document.

Spotting Hidden Fees and Overcharges

The payment processing industry is notorious for its complex fee structures. Some providers may intentionally make statements confusing to obscure unnecessary charges, padded fees, or sudden price hikes. A regular, detailed review is your first line of defense against being overcharged. You can’t question a fee you don’t know you’re paying.

Optimizing Your Payment Processing Costs

Your statement reveals exactly how you are being charged for every single transaction. By understanding the breakdown, you can see if your current pricing model is truly the best fit for your business. For example, you might discover that a large percentage of your transactions are being downgraded to more expensive tiers, a problem you can address with your provider. Optimizing these costs is a core benefit of choosing the right merchant services for small business.

Ensuring Fair Pricing from Your Provider

How do you know if you’re getting a good deal from your payment processor? Your statement holds the answer. By calculating your “effective rate” (total fees divided by total sales volume), you get a single, clear metric to compare with industry averages or quotes from other providers. This number cuts through the marketing jargon and tells you the real cost of your merchant services for small business.

Making Informed Decisions About merchant services for small business

Your business is always evolving, and your payment needs may change with it. A consistent review of your statements provides the data you need to make informed decisions. You might notice a shift in the types of cards your customers use, or that your average transaction size has changed. This information is vital when negotiating rates or considering a switch to a new provider of merchant services for small business.

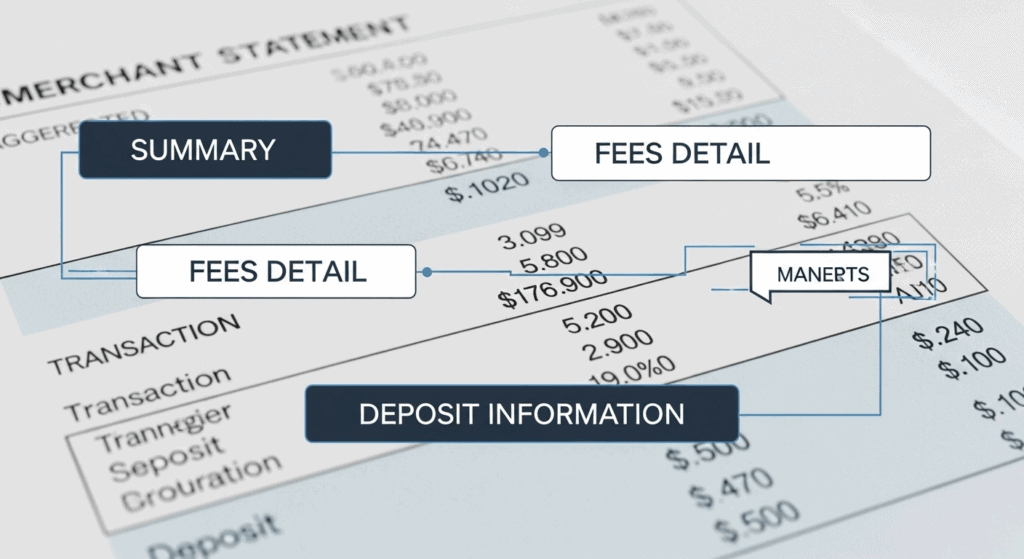

The Anatomy of a Merchant Statement: Key Sections to Know

While the layout can vary between providers, most statements contain the same core sections. Familiarizing yourself with this general structure will help you locate the information you need quickly, regardless of who your provider is.

The Summary Section: Your At-a-Glance Overview

This is usually at the top of the first page. Think of it as the executive summary of your month’s processing activity. It provides the high-level numbers you need for quick accounting.

- Total Sales Volume: The total dollar amount of all credit and debit card transactions you processed during the statement period.

- Total Number of Transactions: The sheer count of individual sales.

- Total Fees: The grand total of all charges deducted by your processor. This is the number most people look at.

- Net Deposit: The amount of money that was actually deposited into your bank account (Total Sales Volume – Total Fees).

This section is great for a quick check, but the real story is in the details that follow. A wise business owner always looks beyond the summary when evaluating their merchant services for small business.

The Deposit Summary: Tracking Your Funds

This section shows a breakdown of deposits made into your bank account. It may be organized by day or by batch. This is a critical area to cross-reference with your own sales records and bank statements. You should be able to match the deposits on your merchant statement to the credits in your business bank account. Discrepancies here could indicate a funding delay or an error that needs immediate attention.

The Fee Detail Section: The Heart of the Statement

This is where the real investigation begins. The fee detail section is an itemized list of every single charge that makes up your “Total Fees.” It can be long, intimidating, and full of jargon. This is where providers often hide unnecessary charges. We will break down these specific fees in the next section, but for now, know that this is the most important part of the document to scrutinize when reviewing your merchant services for small business.

The Card Brand Summary: Visa, Mastercard, Amex, and Discover

Your statement will also include a summary of your sales volume broken down by the major card brands (Visa, Mastercard, American Express, Discover). It might also show you the volume by card type (debit, credit, rewards, corporate). This information is useful for understanding your customers’ payment preferences and for analyzing your interchange costs, which vary significantly between different card types. Managing these costs is a key aspect of superior merchant services for small business.

Decoding the Jargon: A Glossary of Common Merchant Fees

This is where most people get lost. The sheer number of different fees can be overwhelming. Let’s simplify them by breaking them down into three main categories: Wholesale Fees, Processor Markup Fees, and Situational Fees. Understanding this breakdown is the most crucial step in evaluating your merchant services for small business.

Wholesale Fees (The Unavoidable Costs)

These are the baseline costs of payment processing. Your provider doesn’t set these fees; they are set by the card brands (Visa, Mastercard) and the issuing banks (the customer’s bank). Your provider pays these fees on your behalf and passes them on to you. A transparent provider will pass these through at cost.

- Interchange Fees: This is the largest component of your processing costs. An Interchange fee is paid by your processor to the card-issuing bank every time a customer uses their card. The rates are set by the card networks and vary based on dozens of factors, including card type (debit vs. credit, rewards vs. basic), how the transaction was processed (in-person vs. online), and your industry. There are hundreds of individual interchange rates.

- Card Brand Assessments (Scheme Fees): These are smaller fees paid directly to the card brands (Visa, Mastercard, etc.) for the use of their networks. They are typically a small percentage of the processing volume for that brand. Examples include the Visa Acquirer Processing Fee (APF) and the Mastercard Network Access and Brand Usage (NABU) fee.

Processor Markup Fees (Where Providers Make Their Money)

This is the amount your processing provider charges on top of the wholesale fees. This is their profit. The structure and amount of this markup are what differentiate providers and pricing models. When you are shopping for merchant services for small business, this markup is what you are negotiating.

- Processing/Transaction Fees: This can be a percentage of the sale, a flat fee per transaction, or both. This is the provider’s core markup.

- Monthly Fees: A flat fee charged every month for services like statement preparation, customer support, and account maintenance.

- Annual Fees: Some providers charge an additional fee once per year for account upkeep.

- PCI Compliance Fees: A fee charged to cover the costs of ensuring your business meets the Payment Card Industry Data Security Standard (PCI DSS). Some providers charge this annually and may offer services to help you stay compliant, while others may charge a monthly PCI non-compliance fee if you fail to validate your compliance. This is an important part of any package for merchant services for small business.

- Statement Fees: A small fee, often a few dollars, just for the “privilege” of receiving a paper or even a digital statement.

- Terminal Lease/Rental Fees: If you don’t purchase your credit card terminal outright, you’ll see a monthly fee for leasing or renting the equipment. It’s almost always more cost-effective to buy your equipment.

Situational Fees (The “Gotchas”)

These are fees that you are only charged when a specific event occurs. They can often be avoided with proper business practices.

- Chargeback Fees: When a customer disputes a transaction and a chargeback is initiated, your provider will charge you a significant fee (e.g.,

15−15−50) simply for handling the case, regardless of whether you win or lose. - Retrieval Fees: A fee charged when a cardholder’s bank requests a copy of a transaction receipt. This often precedes a chargeback.

- Non-Sufficient Funds (NSF) Fees: If the processor tries to debit your fees from your bank account and you don’t have enough funds, you’ll be hit with an NSF fee, similar to a bounced check fee.

- Early Termination Fees (ETF): If your contract has a long-term commitment and you decide to leave before it expires, you could face a hefty penalty. Always look for providers of merchant services for small business that offer month-to-month agreements with no cancellation fees.

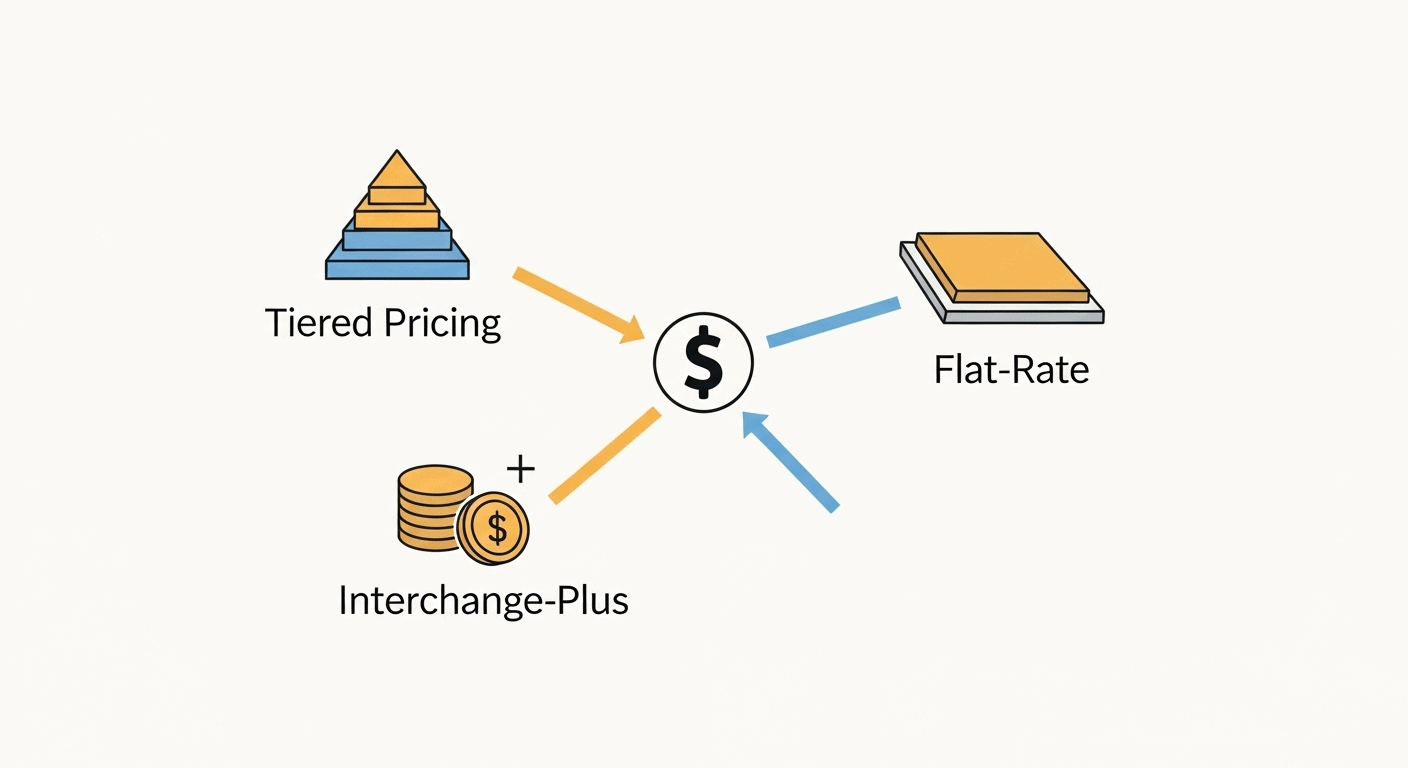

Understanding Different Pricing Models

The markup we just discussed is applied through different pricing models. The model you’re on dramatically affects your statement’s transparency and your total cost. Finding the right model is the goal when selecting merchant services for small business.

Tiered Pricing (Qualified, Mid-Qualified, Non-Qualified)

Tiered pricing bundles the hundreds of interchange rates into three simple buckets or “tiers.”

- Qualified: The lowest rate, typically reserved for standard debit cards and non-rewards credit cards swiped in person.

- Mid-Qualified: A higher rate for transactions that don’t meet the “qualified” criteria, like manually keyed-in cards or certain rewards cards.

- Non-Qualified: The highest rate, for premium rewards cards, corporate cards, and online transactions.

The problem with tiered pricing is its lack of transparency. The provider decides which transactions fall into which tier, and they often route the majority of transactions to the more expensive Mid- and Non-Qualified tiers, inflating your costs. Many experts advise against this model when seeking merchant services for small business.

Interchange-Plus (Cost-Plus) Pricing

This is widely considered the most transparent and fair pricing model. It separates the two main cost components:

- The “Interchange”: The true wholesale interchange fees and card brand assessments are passed directly through to you at cost.

- The “Plus”: The provider’s markup is a fixed percentage and/or a flat per-transaction fee applied on top.

On your statement, you will see the true interchange cost for each transaction and the provider’s markup listed separately. This transparency allows you to see exactly what you’re paying in wholesale costs versus processor profit. This is the preferred model for most companies looking for long-term, affordable merchant services for small business.

Flat-Rate Pricing

This model was popularized by companies like Square and PayPal. You pay a single flat percentage and sometimes a small per-transaction fee for every transaction, regardless of the card type.

- Pros: It’s incredibly simple and predictable. You always know exactly what you’re going to pay.

- Cons: That simplicity comes at a cost. The flat rate needs to be high enough to cover the processor’s most expensive transactions (like a premium corporate rewards card). This means you are likely overpaying on less expensive transactions, like debit cards. It’s great for very small or occasional sellers, but businesses with higher volumes can usually find better rates with Interchange-Plus merchant services for small business.

Pricing Model Comparison Table

| Feature | Tiered Pricing | Interchange-Plus Pricing | Flat-Rate Pricing |

| Transparency | Low. The processor bundles interchange costs, hiding the true cost and their markup. | High. Wholesale costs and the processor’s markup are listed separately. | High. The single rate is very clear, but the underlying wholesale cost is hidden. |

| Predictability | Low. It’s difficult to predict which tier a transaction will fall into, leading to fluctuating monthly costs. | Medium. The markup is fixed, but wholesale interchange fees vary by card type. | High. Costs are very easy to predict as a fixed percentage of sales volume. |

| Overall Cost | Often the highest. Processors can inflate profits by downgrading transactions to more expensive tiers. | Often the lowest, especially for established businesses with steady volume. | Can be high for businesses with high volume or a high percentage of debit card sales. |

| Statement Complexity | Deceptively simple on the surface but difficult to truly analyze without transparency. | Can appear complex due to the detailed breakdown of interchange fees, but is the most informative. | Very simple. The statement is usually the easiest to read of the three models. |

| Best For | Rarely recommended due to the lack of transparency and potential for overcharging. | Most small to medium-sized businesses looking for fair, transparent pricing. | Micro-businesses, startups, or businesses with very low or inconsistent sales volume. |

A Step-by-Step Guide to Reviewing Your Statement

Now you have the knowledge. Let’s put it into action. Set aside 30 minutes each month to perform this financial health check-up on your merchant services for small business.

Step 1: Gather Your Statements

Have your last three months of merchant statements available. This will allow you to compare and spot trends or sudden changes. Also, have your own sales records and bank statements for the same period ready for cross-referencing.

Step 2: Calculate Your Effective Rate

This is the single most important metric you can pull from your statement. It gives you your true “all-in” cost of accepting cards.

Formula: (Total Monthly Fees / Total Monthly Sales Volume) x 100 = Effective Rate (%)

For example, if you paid $300 in fees on $10,000 in sales, your effective rate is 3.0%. Calculate this for each of the last three months. Is it stable? Is it going up? This rate is your ultimate benchmark for evaluating your merchant services for small business.

Step 3: Scrutinize the Fee Detail Section

Go through the itemized list of fees line by line.

- Do you understand every single fee listed?

- Are there any fees with vague names like “Service Fee” or “Admin Fee”? These are red flags.

- If you are on an Interchange-Plus plan, check that the markup matches what you agreed to in your contract.

- If you are on a Tiered plan, look at the volume of sales being routed to each tier. If a large portion is Non-Qualified, you are likely overpaying.

Step 4: Compare Month-over-Month

Look at the statements side-by-side. Did any specific fee suddenly appear or increase without warning? Some processors sneak in small fee increases over time, hoping you won’t notice. This is a common tactic, and only a diligent review will catch it. Consistent pricing is a hallmark of good merchant services for small business.

Step 5: Question Everything with Your Provider

Don’t be afraid to call your provider’s customer support line. Ask them to explain any fee you don’t understand. Ask why your rates may have increased. A good provider will be able to give you clear, straightforward answers. If they are evasive or can’t explain the charges, it might be a sign that it’s time to look for new merchant services for small business.

Common Red Flags to Watch For on Your Statement

As you review, keep an eye out for these common warning signs that your merchant services for small business may not be serving you well.

Sudden Fee Increases

Unless the card brands have announced a major interchange rate adjustment (which is rare and well-publicized), your processing fees should not change without prior notification. Unannounced increases are a major red flag and a breach of trust.

Vague or Undefined Fees

Beware of fees with generic names like “Miscellaneous Fee,” “Surcharge,” or “Processing Fee” without further explanation. Every single charge should have a clear purpose. These are often just padding to increase the processor’s profit.

Incorrect Downgrades (Especially on Tiered Plans)

If you notice that transactions which should be “Qualified” (like a standard credit card swiped in person) are appearing in the “Non-Qualified” bucket, you need to question your provider. This is a common way that processors using the tiered model inflate their profits at your expense.

Discrepancies Between Sales and Deposits

The deposit summary on your statement should line up perfectly with your bank records. Any discrepancies, after accounting for processing times, need to be investigated immediately. It could be a simple batch error or something more serious. Reliable funding is a non-negotiable feature of quality merchant services for small business.

How to Choose the Right merchant services for small business

Armed with the knowledge of how to read a statement, you are now in a powerful position to choose the best provider for your needs. Here’s what to look for.

Prioritize Transparent Pricing

Insist on Interchange-Plus pricing. Ask for a full proposal that clearly outlines every single fee you will be charged. If a provider is hesitant to offer this model or cannot clearly explain their pricing, walk away. The best providers of merchant services for small business compete on transparency.

Look for Excellent Customer Support

When you have a question or a problem, you need access to knowledgeable, helpful support. Before you sign up, call their support line. Are they easy to reach? Are they helpful? Read online reviews about their customer service. A low price is worthless if you can’t get help when your system goes down.

Ensure Security and PCI Compliance

Your provider must be a leader in security and help you easily maintain your PCI compliance. Ask about their security features, such as tokenization and end-to-end encryption. A good partner in merchant services for small business will make compliance straightforward, not a burden.

Consider Integration Capabilities

Does the provider’s equipment and software integrate with your existing systems, such as your Point of Sale (POS) system or accounting software? Seamless integration can save you hours of administrative work and reduce errors. This is a key value-add for modern merchant services for small business.

Conclusion: From Confusion to Control

Your merchant statement is no longer a cryptic puzzle. It is a powerful tool. By investing a small amount of time each month to read and understand it, you are taking a proactive step toward managing your expenses, protecting your business from overcharges, and ensuring you have the right financial partners on your side.

You are now equipped with the knowledge to decode the jargon, understand the pricing models, and spot the red flags. This empowers you to have intelligent, confident conversations with your provider and to make the best possible decisions for your company’s future. The world of payment processing can be complex, but by mastering your statement, you have taken a giant leap from confusion to control, ensuring your chosen merchant services for small business are truly working for you.

Frequently Asked Questions (FAQ)

1. What is the single most important number on my merchant statement?

The most important metric you can calculate is your “effective rate.” It’s found by dividing your total monthly fees by your total monthly sales volume. This single percentage tells you your true all-in cost and is the best number to use when comparing your current provider to others offering merchant services for small business.

2. Why are my fees higher this month than last month, even though my sales were the same?

This could be due to several factors. You might have accepted more “expensive” cards (like corporate or premium rewards cards), which have higher interchange fees. If you’re on a tiered plan, more of your transactions may have been downgraded to a more expensive tier. It could also be that your provider added a new fee or increased an existing one without notice, which is a red flag.

3. What is the difference between an authorization fee and a transaction fee?

An authorization fee is a charge for the act of “checking” with the customer’s bank to see if they have sufficient funds, which happens on every attempted transaction (even declined ones). A transaction fee is a broader term that often refers to the processor’s markup for a successfully completed sale. Some providers charge both, so it’s important to clarify this when evaluating merchant services for small business.

4. My provider is charging me a “PCI Non-Compliance Fee.” What is this and how can I avoid it?

The Payment Card Industry Data Security Standard (PCI DSS) is a set of security rules for businesses that handle card information. Most providers require you to complete an annual self-assessment questionnaire to validate your compliance. If you fail to do this, they charge a monthly non-compliance fee as a penalty. To avoid it, simply complete the required assessment on time each year.

5. Is Interchange-Plus pricing always the best model?

For the vast majority of small and medium-sized businesses, Interchange-Plus is the most transparent and cost-effective model. However, for a brand-new business with very low or unpredictable sales volume (e.g., less than $3,000/month), the simplicity of Flat-Rate pricing might be more convenient, even if it’s slightly more expensive per transaction. As your business grows, migrating to Interchange-Plus is almost always the best financial move.