By Rinki Pandey September 9, 2025

Rate Match Credit Card Processing Navigating the world of merchant services can often feel like trekking through a dense, confusing jungle. The landscape is filled with complex terminology, varying pricing structures, and the constant, nagging feeling that you might be overpaying. For any business owner, credit card processing fees are a significant and unavoidable operational cost. But what if you could ensure you’re getting the most competitive rate available? This is where the powerful strategy of rate match credit card processing comes into play.

Many business owners are familiar with price matching in a retail context, but fewer realize this same principle can be applied to their merchant services account, potentially saving them hundreds or even thousands of dollars annually. The challenge, however, is that a rate match credit card processing offer isn’t always as straightforward as it seems. It requires a keen eye, a bit of preparation, and a solid understanding of what you’re truly being offered.

This comprehensive guide is designed to demystify the entire process. We will break down what a rate match credit card processing program entails, explain the intricate components of processing fees, and provide you with a step-by-step blueprint for successfully negotiating a better deal. By the end of this article, you will be empowered with the knowledge to confidently approach any payment processor, dissect their proposals, and secure the best possible pricing for your business.

What Exactly is Rate Match Credit Card Processing?

At its core, the concept is simple. However, the application in the merchant services industry is layered with nuance. Understanding this foundation is the first step toward leveraging this powerful tool for your business’s financial health.

Defining the Core Concept

A rate match credit card processing offer is a commitment from a payment processor to meet or beat the pricing terms offered to you by a competing provider. It’s a competitive tactic designed to either win your business or prevent you from leaving their service for a competitor.

Think of it like getting a quote for a home repair. You might get an estimate from Contractor A, then show it to Contractor B to see if they can offer a better price for the same quality of work. In the world of payment processing, you present a competitor’s proposal to your current or a prospective processor, and they attempt to match the rates and fees to secure your account. A successful rate match credit card processing negotiation can significantly lower your monthly expenses.

Why Do Processors Offer Rate Matching?

The payment processing industry is incredibly competitive. There are countless providers, from large-scale banks to smaller independent sales organizations (ISOs), all vying for the same pool of merchants. Offering a rate match credit card processing program is a primary strategy for two key reasons:

- Customer Acquisition: For a processor trying to win your business, offering to match or beat your current rate is their most direct and compelling sales pitch. It immediately addresses your primary concern: cost.

- Customer Retention: For your current provider, a rate match credit card processing promise is a crucial retention tool. It’s far more cost-effective for them to lower your rate and keep you as a customer than it is to lose you and spend marketing dollars to acquire a new merchant to replace you. They are betting that the convenience of staying with them, combined with a lower rate, is enough to prevent you from switching.

Is a Rate Match Guarantee Always What It Seems?

This is where diligence becomes paramount. While the promise sounds fantastic, the execution can be tricky. A less-than-scrupulous provider might claim to match your rate but will compensate for the lower margin by inflating other fees, locking you into a long-term equipment lease, or using a confusing pricing model where the “match” only applies to a small fraction of your transactions.

A genuine rate match credit card processing analysis requires you to look beyond the headline percentage and scrutinize the entire fee structure. Without this deep dive, you risk ending up in a worse financial position than before, even with a seemingly lower rate. The goal is to achieve a true apples-to-apples comparison, which we will explore in detail.

The Anatomy of Credit Card Processing Fees: What Are You Actually Matching?

To successfully navigate a rate match credit card processing negotiation, you must first understand the three core components of the fees you pay. A processor’s offer can only be truly evaluated when you know which parts are negotiable and which are not. Failing to grasp this distinction is the most common mistake business owners make.

Interchange Fees: The Unchangeable Component

Interchange fees make up the largest portion of your credit card processing costs, typically accounting for 70-90% of the total amount you pay. These fees are set directly by the card networks (Visa, Mastercard, Discover, American Express) and are paid to the card-issuing bank (the customer’s bank).

There are hundreds of different interchange rates, and they vary based on numerous factors:

- The type of card used (e.g., standard debit, rewards credit card, corporate card).

- The way the card is processed (e.g., swiped/dipped, keyed-in online).

- The type of business accepting the card.

Crucially, interchange fees are non-negotiable. No payment processor, regardless of their size or influence, can get you a lower interchange rate. When a provider talks about a rate match credit card processing deal, they are never talking about changing this portion of the fee. Any claim to the contrary is a major red flag.

Assessment Fees: The Card Brand’s Cut

Assessments are a much smaller percentage fee, also set by the card networks themselves. This is their fee for using their network. Like interchange, these fees are non-negotiable and are passed directly through to the merchant. They are a fixed cost of doing business, and no rate match credit card processing offer can alter them. Together, interchange and assessments form the “wholesale” cost of a transaction.

The Processor’s Markup: The Only Negotiable Part

This is it. The processor’s markup is the only part of your credit card processing fees that is negotiable. This is what the processing company charges for its services, which include routing the transaction, providing customer support, statement preparation, and assuming the risk. When you are negotiating a rate match credit card processing offer, you are exclusively negotiating this markup.

The way a processor structures this markup is defined by their pricing model. Understanding these models is essential to achieving a true rate match.

- Tiered Pricing: This model bundles the hundreds of interchange rates into a few simple “tiers,” usually labeled Qualified, Mid-Qualified, and Non-Qualified. The processor advertises the low “Qualified” rate, but many of your transactions (like rewards cards or online payments) are “downgraded” to the more expensive tiers. This model lacks transparency and makes a true rate match credit card processing comparison nearly impossible, as you don’t know how the new processor will categorize your transactions.

- Flat-Rate Pricing: Popularized by companies like Square and Stripe, this model charges one single, flat rate for all transactions (e.g., 2.9% + 30¢). Its main benefit is simplicity and predictability. However, for businesses with a high volume of low-cost debit card transactions, it can be significantly more expensive than other models. A rate match credit card processing is less common here, as the model’s entire premise is its fixed, non-negotiable nature.

- Interchange-Plus (Cost-Plus) Pricing: This is widely considered the most transparent and fair pricing model. The processor passes the true, non-negotiable interchange and assessment costs directly to you and then adds a small, fixed, and clearly disclosed markup. For example, a rate might be quoted as “Interchange + 0.20% + 10¢.” This model allows you to see exactly what you are paying the card brands and what the processor is earning. For any serious rate match credit card processing analysis, demanding a quote in the Interchange-Plus format is non-negotiable.

How to Prepare for a Rate Match Credit Card Processing Negotiation

You cannot walk into a negotiation unprepared and expect to win. To effectively request and evaluate a rate match credit card processing offer, you need to do your homework. This preparation will arm you with the data needed to argue your case and spot a poor offer from a mile away.

Step 1: Gather Your Current Processing Statements

Your merchant processing statements are your most valuable asset in this process. You will need to gather at least three, but preferably six, consecutive months’ worth of statements from your current provider. These documents contain the raw data that tells the story of your processing costs.

When reviewing them, try to identify the following key information:

- Total Sales Volume: The total dollar amount of credit and debit card sales you processed each month.

- Total Fees Paid: The total amount your processor charged you.

- Number of Transactions: The total count of individual sales.

- Average Ticket Size: Calculated by dividing your Total Sales Volume by your Number of Transactions.

- Pricing Model: Look for clues. If you see terms like “QUAL,” “MID,” or “NON-QUAL,” you are on a Tiered plan. If you see detailed interchange fee pass-throughs, you are likely on Interchange-Plus.

Step 2: Calculate Your Current Effective Rate

The “effective rate” is a single, powerful metric that gives you a high-level benchmark of your current costs. It blends all your processing fees—percentage rates, transaction fees, and monthly fees—into one simple percentage. This is a crucial number for any rate match credit card processing discussion.

The formula is straightforward:

(Total Monthly Fees ÷ Total Monthly Sales Volume) x 100 = Effective Rate (%)

For example, if you paid $600 in total fees on $20,000 of sales, your effective rate is 3.0%. Calculate this for each of the months you have statements for. This gives you a clear, objective baseline. When a new processor promises a lower rate, you can compare their proposed effective rate to your current one. An honest rate match credit card processing offer should result in a tangibly lower effective rate.

Step 3: Obtain a Competing Quote

With your data in hand, it’s time to go shopping. Reach out to at least two or three other reputable payment processors and request a formal proposal. Be explicit in your request: you want a full cost analysis based on your recent statements and a quote presented in the Interchange-Plus pricing model.

Do not accept a quote in a Tiered format. Insisting on Interchange-Plus forces the provider to be transparent and gives you a clear basis for comparison. This competing quote is the leverage you will use to initiate the rate match credit card processing conversation with your current provider or to validate a new provider’s offer. Without a competing, data-backed proposal, your request for a rate match is just a shot in the dark.

The Apples-to-Apples Comparison: Decoding a Rate Match Offer

You’ve done your homework, you have your current statements, and you have a competing offer in hand. Now comes the most critical phase: analyzing the rate match credit card processing proposal to ensure it’s a genuine improvement. This requires looking beyond the advertised rate and dissecting every line item.

Scrutinizing the Pricing Model

As we’ve discussed, the pricing model is everything. If your current provider is on a Tiered plan and a competitor offers you a rate match credit card processing deal on an Interchange-Plus plan, you are not comparing apples to apples. The tiered model can hide exorbitant markups on “non-qualified” transactions.

Your goal should be to get all providers, including your current one, to offer you pricing on an Interchange-Plus basis. Only then can you accurately compare the processor’s markup—the only part that matters. If a processor is unwilling to provide an Interchange-Plus quote, it’s a significant red flag that suggests they rely on a lack of transparency to maintain their profit margins. A truly confident rate match credit card processing offer will always be presented with full transparency.

Uncovering Hidden and Incidental Fees

A common tactic used to undermine a rate match credit card processing promise is to lower the percentage rate while simultaneously increasing or adding various monthly, annual, or incidental fees. A reduction of 0.10% on your processing rate can be completely wiped out by a new $25 monthly “statement fee” or a $99 annual “PCI compliance fee.”

You must create a checklist of all potential fees and ask the provider to identify every single one you will be charged. This detailed analysis is fundamental to any legitimate rate match credit card processing evaluation.

Here is a table of common fees to look for when comparing offers:

| Fee Category | Fee Name | Description | What to Look For |

| Monthly Fees | Statement Fee | A fee for preparing and providing your monthly statement. | Can range from $0 to $25. Question any fee over $10. |

| Gateway Fee | A fee for the payment gateway service required for e-commerce or virtual terminals. | Ensure it’s competitive. Can often be bundled. | |

| Monthly Minimum | A penalty fee charged if your processing fees don’t reach a certain threshold. | Negotiate to have this waived or lowered, especially for seasonal businesses. | |

| Annual Fees | PCI Compliance Fee | A fee for services related to ensuring you meet Payment Card Industry security standards. | Some processors bundle this; others charge up to $199. Ask what support is included. |

| Transactional Fees | Batch Fee | A small fee charged each time you settle your daily batch of transactions. | Typically around $0.10 – $0.30 per day. Ensure it’s not excessively high. |

| AVS Fee | Address Verification Service fee, often charged for e-commerce transactions. | Usually a few cents per transaction. Make sure it’s disclosed upfront. | |

| Incidental Fees | Chargeback Fee | A penalty fee charged when a customer disputes a transaction. | This is standard, but the fee amount can vary from $15 to $50. |

| Early Termination Fee (ETF) | A substantial penalty for closing your account before the contract term ends. | The biggest red flag. Aim for a provider with no ETF. A multi-year contract with a high ETF can trap you, invalidating any benefit from a rate match credit card processing deal. |

This detailed fee analysis is a non-negotiable step in the rate match credit card processing journey.

The Equipment Trap: Leases vs. Purchases

Another way processors can obscure a bad deal is through equipment. They might offer a fantastic rate match credit card processing deal on the rates but insist you sign a multi-year, non-cancellable lease for a “free” or “low-cost” credit card terminal.

These leases are almost always a terrible deal. A terminal that costs $300 to purchase outright could end up costing you over $1,500 over the course of a four-year lease. The lease is often with a third-party company, meaning even if you leave the processor, you are still on the hook for the remaining lease payments. Always insist on purchasing equipment outright or using a provider that offers a free placement program with no long-term contract.

Executing the Rate Match Strategy: A Step-by-Step Guide

With your comprehensive analysis complete, you are now ready to engage with processors and execute your strategy. This is where your preparation pays off, allowing you to negotiate from a position of strength and clarity.

Presenting Your Competing Offer

Start with your current provider. Contact your account representative or their support department. Be professional, polite, and data-driven. Avoid making emotional demands; instead, present your case logically.

You might say something like: “Hello, I’ve been reviewing my processing costs and have received a more competitive offer from another provider. I have been a loyal customer and would prefer to stay with your service. I’ve attached my last three statements and the competing proposal. Could you please conduct a rate match credit card processing analysis to see if you can match these terms?”

By providing all the necessary documents, you make it easy for them to review your account and make a counter-offer. This professional approach is more likely to yield a positive result than an aggressive demand. Initiating a rate match credit card processing request this way opens a constructive dialogue.

Analyzing Their Counter-Offer

When your provider returns with a counter-offer, do not accept it at face value. It’s time to put your analytical skills to work.

- Check the Pricing Model: Did they switch you to a transparent Interchange-Plus model as requested? If not, push back and ask for it.

- Verify the Markup: Is their proposed markup (the “plus” part of Interchange-Plus) truly matching or beating the competitor’s offer?

- Run the Numbers: Using a recent statement, manually calculate what your total fees would have been under their new proposed pricing. Compare this to your old fees and the competitor’s proposal. Does it result in real, tangible savings?

- Review All Fees: Go through your fee checklist from the table above. Did they sneak in any new monthly or annual fees to offset the lower rate? The success of your rate match credit card processing effort depends on this level of detail.

- Get It in Writing: Do not accept a verbal agreement. Insist on a formal, written addendum to your contract that clearly outlines the new pricing structure, all associated fees, and confirms that there is no extension to your contract term.

When to Stay and When to Switch

Your decision should be based on the quality and transparency of the counter-offer.

- When to Stay: If your current provider meets the challenge with a transparent, competitive rate match credit card processing offer that is written down and saves you money, staying is often the path of least resistance. You avoid the hassle of setting up a new account, reprogramming equipment, and training staff.

- When to Switch: If your current provider is evasive, refuses to offer an Interchange-Plus quote, tries to confuse you with complex language, or only offers a partial match while adding new fees, it’s a clear sign that their business model relies on keeping their customers in the dark. In this case, you should confidently move forward with the new provider who has already demonstrated transparency and offered a better deal. The short-term inconvenience of switching will be well worth the long-term savings and peace of mind. A failed rate match credit card processing attempt with your current provider is often the best indicator that it’s time for a change.

Common Pitfalls to Avoid in Your Rate Match Quest

Even with the best preparation, there are several common traps that can derail your rate match credit card processing efforts. Being aware of these pitfalls will help you stay on track and avoid costly mistakes.

The “Too Good to Be True” Rate

Be extremely wary of any offer that seems dramatically lower than all others. Some processors use deceptive tactics like:

- Teaser Rates: They offer an incredibly low introductory rate that skyrockets after a few months. Always ask if the proposed rate is permanent and get it in writing.

- Selective Application: The advertised low rate may only apply to a very specific transaction type, like “qualified, swiped debit cards.” All other transactions, which may constitute the bulk of your sales, will be processed at a much higher rate. This is why an Interchange-Plus model is so important; it negates this trick. A proper rate match credit card processing must apply to your entire processing volume.

Ignoring the Fine Print and Contract Terms

The merchant agreement is a legally binding contract. Failing to read it can have severe financial consequences. Before signing anything—even a rate match addendum—you must review the fine print carefully.

Pay special attention to:

- Contract Length: Are you being locked into a new one, two, or three-year term?

- Early Termination Fee (ETF): Is there a penalty for leaving early? How much is it? A high ETF can make you a captive customer, negating any future negotiating power. The best providers offer month-to-month agreements with no cancellation fees.

- Rate Increase Clauses: Does the contract give the processor the right to raise your rates with little or no notice? A great rate match credit card processing deal is worthless if they can unilaterally raise your markup three months later.

Focusing Solely on Rate and Not on Service

While the goal of a rate match credit card processing is to lower your costs, the rate is not the only factor to consider. The quality of the service and support you receive is also critically important.

Imagine your payment system goes down during your busiest day of the year. The few hundred dollars you saved from a rock-bottom rate will feel meaningless if you can’t reach a knowledgeable support person to help you get back online. When evaluating providers, consider:

- Customer Support: Is their support team available 24/7? Are they based in your country? What are their online reviews like?

- Reliability and Security: Does the provider have a strong reputation for uptime and data security?

- Integration and Technology: Does their platform integrate smoothly with your existing POS system or e-commerce software?

Sometimes, paying a slightly higher markup to a top-tier provider with excellent service is a better long-term business decision than chasing the absolute lowest price from an unknown entity.

The Long-Term Value of Understanding Rate Match Credit Card Processing

Securing a better processing rate is not a one-and-done activity. It is an ongoing process of financial management. The skills you develop by learning how to properly execute a rate match credit card processing analysis will serve your business for years to come.

This knowledge empowers you to be a proactive manager of your company’s expenses. Set a calendar reminder to review your processing statements every six to twelve months. Calculate your effective rate and see if it has crept up. The processing industry is dynamic; rates change, and new fees can be introduced.

By staying vigilant, you can ensure you always have the most competitive pricing available. Your understanding of rate match credit card processing transforms you from a passive rate-payer into an informed and empowered business owner who is in full control of this critical aspect of your finances. This is not just about saving money on one bill; it’s about building a more resilient and profitable business for the future. Your mastery of the rate match credit card processing process is a valuable, long-term asset.

Take Control of Your Processing Costs

The world of credit card processing fees doesn’t have to be an expensive mystery. A rate match credit card processing strategy, when executed with knowledge and diligence, is one of the most effective tools a business owner has to reduce overhead and boost the bottom line.

The journey begins with understanding that you are only negotiating the processor’s markup. It requires you to gather your data, calculate your effective rate, and insist on the transparency of an Interchange-Plus pricing model. By carefully analyzing not just the rates but the entire fee structure, contract terms, and equipment costs, you can confidently distinguish a genuinely good deal from a cleverly disguised trap.

Don’t continue to passively accept your monthly processing bill as an unchangeable cost. Use this guide to take action. Analyze your statements, seek out competitive offers, and engage your provider from a position of knowledge. A successful rate match credit card processing negotiation is within your reach, and the savings you secure will go directly back into growing your business.

Frequently Asked Questions (FAQ)

1. Can any business request a rate match for credit card processing?

Yes, virtually any business that accepts credit cards can and should request a rate match. Whether you are a small retail shop or a large e-commerce enterprise, if you have processing history (at least 3-6 months of statements), you have the necessary data to ask your current provider to match a competitor’s offer or to shop for a new provider.

2. What is the single most important document I need for a rate match?

Your most recent merchant processing statements (at least three consecutive months) are the most critical documents. They contain all the data a processor needs to understand your sales volume, transaction types, and current costs, allowing them to perform a detailed cost analysis and present an accurate and competitive rate match credit card processing proposal.

3. Is the lowest rate always the best deal?

No, absolutely not. A low “teaser” rate can be offset by high monthly fees, expensive equipment leases, or a long-term contract with a hefty early termination fee. A truly great deal is one that offers a competitive rate on a transparent pricing model (like Interchange-Plus) combined with minimal monthly fees, no long-term contract, and reliable customer support. A holistic review is essential for any rate match credit card processing evaluation.

4. What is Interchange-Plus pricing and why is it important for rate matching?

Interchange-Plus pricing is a transparent model where the processor passes through the non-negotiable interchange and assessment fees from the card brands directly to you and then adds their own separate, fixed markup. It is crucial for a rate match credit card processing because it allows for a true apples-to-apples comparison of what different processors are actually charging for their services.

5. How often should I review my processing fees and consider a rate match?

It is a good business practice to conduct a thorough review of your credit card processing fees at least once a year. This involves recalculating your effective rate and checking for any new or increased fees on your statements. If you notice a significant cost increase or it has been more than two years, it is a perfect time to seek competitive quotes and initiate a rate match credit card processing review.

Navigating the world of merchant services can often feel like trekking through a dense, confusing jungle. The landscape is filled with complex terminology, varying pricing structures, and the constant, nagging feeling that you might be overpaying. For any business owner, credit card processing fees are a significant and unavoidable operational cost. But what if you could ensure you’re getting the most competitive rate available? This is where the powerful strategy of rate match credit card processing comes into play.

Many business owners are familiar with price matching in a retail context, but fewer realize this same principle can be applied to their merchant services account, potentially saving them hundreds or even thousands of dollars annually. The challenge, however, is that a rate match credit card processing offer isn’t always as straightforward as it seems. It requires a keen eye, a bit of preparation, and a solid understanding of what you’re truly being offered.

This comprehensive guide is designed to demystify the entire process. We will break down what a rate match credit card processing program entails, explain the intricate components of processing fees, and provide you with a step-by-step blueprint for successfully negotiating a better deal. By the end of this article, you will be empowered with the knowledge to confidently approach any payment processor, dissect their proposals, and secure the best possible pricing for your business.

What Exactly is Rate Match Credit Card Processing?

At its core, the concept is simple. However, the application in the merchant services industry is layered with nuance. Understanding this foundation is the first step toward leveraging this powerful tool for your business’s financial health.

Defining the Core Concept

A rate match credit card processing offer is a commitment from a payment processor to meet or beat the pricing terms offered to you by a competing provider. It’s a competitive tactic designed to either win your business or prevent you from leaving their service for a competitor.

Think of it like getting a quote for a home repair. You might get an estimate from Contractor A, then show it to Contractor B to see if they can offer a better price for the same quality of work. In the world of payment processing, you present a competitor’s proposal to your current or a prospective processor, and they attempt to match the rates and fees to secure your account. A successful rate match credit card processing negotiation can significantly lower your monthly expenses.

Why Do Processors Offer Rate Matching?

The payment processing industry is incredibly competitive. There are countless providers, from large-scale banks to smaller independent sales organizations (ISOs), all vying for the same pool of merchants. Offering a rate match credit card processing program is a primary strategy for two key reasons:

- Customer Acquisition: For a processor trying to win your business, offering to match or beat your current rate is their most direct and compelling sales pitch. It immediately addresses your primary concern: cost.

- Customer Retention: For your current provider, a rate match credit card processing promise is a crucial retention tool. It’s far more cost-effective for them to lower your rate and keep you as a customer than it is to lose you and spend marketing dollars to acquire a new merchant to replace you. They are betting that the convenience of staying with them, combined with a lower rate, is enough to prevent you from switching.

Is a Rate Match Guarantee Always What It Seems?

This is where diligence becomes paramount. While the promise sounds fantastic, the execution can be tricky. A less-than-scrupulous provider might claim to match your rate but will compensate for the lower margin by inflating other fees, locking you into a long-term equipment lease, or using a confusing pricing model where the “match” only applies to a small fraction of your transactions.

A genuine rate match credit card processing analysis requires you to look beyond the headline percentage and scrutinize the entire fee structure. Without this deep dive, you risk ending up in a worse financial position than before, even with a seemingly lower rate. The goal is to achieve a true apples-to-apples comparison, which we will explore in detail.

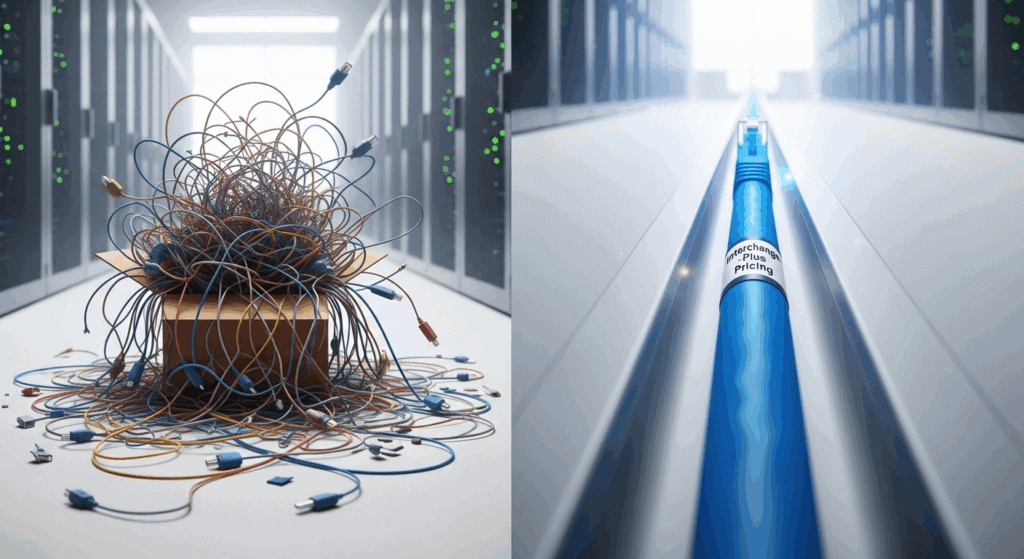

Image Prompt 1: A brightly lit, split-screen image. On the left, a tangled mess of various colored wires and cables, representing the confusion of complex processing fees. On the right, a single, straight, and neatly organized cable, symbolizing the clarity and transparency of a well-understood Interchange-Plus pricing model.

The Anatomy of Credit Card Processing Fees: What Are You Actually Matching?

To successfully navigate a rate match credit card processing negotiation, you must first understand the three core components of the fees you pay. A processor’s offer can only be truly evaluated when you know which parts are negotiable and which are not. Failing to grasp this distinction is the most common mistake business owners make.

Interchange Fees: The Unchangeable Component

Interchange fees make up the largest portion of your credit card processing costs, typically accounting for 70-90% of the total amount you pay. These fees are set directly by the card networks (Visa, Mastercard, Discover, American Express) and are paid to the card-issuing bank (the customer’s bank).

There are hundreds of different interchange rates, and they vary based on numerous factors:

- The type of card used (e.g., standard debit, rewards credit card, corporate card).

- The way the card is processed (e.g., swiped/dipped, keyed-in online).

- The type of business accepting the card.

Crucially, interchange fees are non-negotiable. No payment processor, regardless of their size or influence, can get you a lower interchange rate. When a provider talks about a rate match credit card processing deal, they are never talking about changing this portion of the fee. Any claim to the contrary is a major red flag.

Assessment Fees: The Card Brand’s Cut

Assessments are a much smaller percentage fee, also set by the card networks themselves. This is their fee for using their network. Like interchange, these fees are non-negotiable and are passed directly through to the merchant. They are a fixed cost of doing business, and no rate match credit card processing offer can alter them. Together, interchange and assessments form the “wholesale” cost of a transaction.

The Processor’s Markup: The Only Negotiable Part

This is it. The processor’s markup is the only part of your credit card processing fees that is negotiable. This is what the processing company charges for its services, which include routing the transaction, providing customer support, statement preparation, and assuming the risk. When you are negotiating a rate match credit card processing offer, you are exclusively negotiating this markup.

The way a processor structures this markup is defined by their pricing model. Understanding these models is essential to achieving a true rate match.

- Tiered Pricing: This model bundles the hundreds of interchange rates into a few simple “tiers,” usually labeled Qualified, Mid-Qualified, and Non-Qualified. The processor advertises the low “Qualified” rate, but many of your transactions (like rewards cards or online payments) are “downgraded” to the more expensive tiers. This model lacks transparency and makes a true rate match credit card processing comparison nearly impossible, as you don’t know how the new processor will categorize your transactions.

- Flat-Rate Pricing: Popularized by companies like Square and Stripe, this model charges one single, flat rate for all transactions (e.g., 2.9% + 30¢). Its main benefit is simplicity and predictability. However, for businesses with a high volume of low-cost debit card transactions, it can be significantly more expensive than other models. A rate match credit card processing is less common here, as the model’s entire premise is its fixed, non-negotiable nature.

- Interchange-Plus (Cost-Plus) Pricing: This is widely considered the most transparent and fair pricing model. The processor passes the true, non-negotiable interchange and assessment costs directly to you and then adds a small, fixed, and clearly disclosed markup. For example, a rate might be quoted as “Interchange + 0.20% + 10¢.” This model allows you to see exactly what you are paying the card brands and what the processor is earning. For any serious rate match credit card processing analysis, demanding a quote in the Interchange-Plus format is non-negotiable.

How to Prepare for a Rate Match Credit Card Processing Negotiation

You cannot walk into a negotiation unprepared and expect to win. To effectively request and evaluate a rate match credit card processing offer, you need to do your homework. This preparation will arm you with the data needed to argue your case and spot a poor offer from a mile away.

Step 1: Gather Your Current Processing Statements

Your merchant processing statements are your most valuable asset in this process. You will need to gather at least three, but preferably six, consecutive months’ worth of statements from your current provider. These documents contain the raw data that tells the story of your processing costs.

When reviewing them, try to identify the following key information:

- Total Sales Volume: The total dollar amount of credit and debit card sales you processed each month.

- Total Fees Paid: The total amount your processor charged you.

- Number of Transactions: The total count of individual sales.

- Average Ticket Size: Calculated by dividing your Total Sales Volume by your Number of Transactions.

- Pricing Model: Look for clues. If you see terms like “QUAL,” “MID,” or “NON-QUAL,” you are on a Tiered plan. If you see detailed interchange fee pass-throughs, you are likely on Interchange-Plus.

Step 2: Calculate Your Current Effective Rate

The “effective rate” is a single, powerful metric that gives you a high-level benchmark of your current costs. It blends all your processing fees—percentage rates, transaction fees, and monthly fees—into one simple percentage. This is a crucial number for any rate match credit card processing discussion.

The formula is straightforward:

(Total Monthly Fees ÷ Total Monthly Sales Volume) x 100 = Effective Rate (%)

For example, if you paid $600 in total fees on $20,000 of sales, your effective rate is 3.0%. Calculate this for each of the months you have statements for. This gives you a clear, objective baseline. When a new processor promises a lower rate, you can compare their proposed effective rate to your current one. An honest rate match credit card processing offer should result in a tangibly lower effective rate.

Step 3: Obtain a Competing Quote

With your data in hand, it’s time to go shopping. Reach out to at least two or three other reputable payment processors and request a formal proposal. Be explicit in your request: you want a full cost analysis based on your recent statements and a quote presented in the Interchange-Plus pricing model.

Do not accept a quote in a Tiered format. Insisting on Interchange-Plus forces the provider to be transparent and gives you a clear basis for comparison. This competing quote is the leverage you will use to initiate the rate match credit card processing conversation with your current provider or to validate a new provider’s offer. Without a competing, data-backed proposal, your request for a rate match is just a shot in the dark.

The Apples-to-Apples Comparison: Decoding a Rate Match Offer

You’ve done your homework, you have your current statements, and you have a competing offer in hand. Now comes the most critical phase: analyzing the rate match credit card processing proposal to ensure it’s a genuine improvement. This requires looking beyond the advertised rate and dissecting every line item.

Scrutinizing the Pricing Model

As we’ve discussed, the pricing model is everything. If your current provider is on a Tiered plan and a competitor offers you a rate match credit card processing deal on an Interchange-Plus plan, you are not comparing apples to apples. The tiered model can hide exorbitant markups on “non-qualified” transactions.

Your goal should be to get all providers, including your current one, to offer you pricing on an Interchange-Plus basis. Only then can you accurately compare the processor’s markup—the only part that matters. If a processor is unwilling to provide an Interchange-Plus quote, it’s a significant red flag that suggests they rely on a lack of transparency to maintain their profit margins. A truly confident rate match credit card processing offer will always be presented with full transparency.

Uncovering Hidden and Incidental Fees

A common tactic used to undermine a rate match credit card processing promise is to lower the percentage rate while simultaneously increasing or adding various monthly, annual, or incidental fees. A reduction of 0.10% on your processing rate can be completely wiped out by a new $25 monthly “statement fee” or a $99 annual “PCI compliance fee.”

You must create a checklist of all potential fees and ask the provider to identify every single one you will be charged. This detailed analysis is fundamental to any legitimate rate match credit card processing evaluation.

Here is a table of common fees to look for when comparing offers:

| Fee Category | Fee Name | Description | What to Look For |

| Monthly Fees | Statement Fee | A fee for preparing and providing your monthly statement. | Can range from $0 to $25. Question any fee over $10. |

| Gateway Fee | A fee for the payment gateway service required for e-commerce or virtual terminals. | Ensure it’s competitive. Can often be bundled. | |

| Monthly Minimum | A penalty fee charged if your processing fees don’t reach a certain threshold. | Negotiate to have this waived or lowered, especially for seasonal businesses. | |

| Annual Fees | PCI Compliance Fee | A fee for services related to ensuring you meet Payment Card Industry security standards. | Some processors bundle this; others charge up to $199. Ask what support is included. |

| Transactional Fees | Batch Fee | A small fee charged each time you settle your daily batch of transactions. | Typically around $0.10 – $0.30 per day. Ensure it’s not excessively high. |

| AVS Fee | Address Verification Service fee, often charged for e-commerce transactions. | Usually a few cents per transaction. Make sure it’s disclosed upfront. | |

| Incidental Fees | Chargeback Fee | A penalty fee charged when a customer disputes a transaction. | This is standard, but the fee amount can vary from $15 to $50. |

| Early Termination Fee (ETF) | A substantial penalty for closing your account before the contract term ends. | The biggest red flag. Aim for a provider with no ETF. A multi-year contract with a high ETF can trap you, invalidating any benefit from a rate match credit card processing deal. |

This detailed fee analysis is a non-negotiable step in the rate match credit card processing journey.

The Equipment Trap: Leases vs. Purchases

Another way processors can obscure a bad deal is through equipment. They might offer a fantastic rate match credit card processing deal on the rates but insist you sign a multi-year, non-cancellable lease for a “free” or “low-cost” credit card terminal.

These leases are almost always a terrible deal. A terminal that costs $300 to purchase outright could end up costing you over $1,500 over the course of a four-year lease. The lease is often with a third-party company, meaning even if you leave the processor, you are still on the hook for the remaining lease payments. Always insist on purchasing equipment outright or using a provider that offers a free placement program with no long-term contract.

Image Prompt 2: A realistic image of a magnifying glass held over a merchant agreement contract. The magnifying glass is focused on the “Early Termination Fee” and “Monthly Fees” clauses, which are rendered in sharp detail, while the rest of the document is slightly blurred. This visual metaphor highlights the importance of scrutinizing the fine print.

Executing the Rate Match Strategy: A Step-by-Step Guide

With your comprehensive analysis complete, you are now ready to engage with processors and execute your strategy. This is where your preparation pays off, allowing you to negotiate from a position of strength and clarity.

Presenting Your Competing Offer

Start with your current provider. Contact your account representative or their support department. Be professional, polite, and data-driven. Avoid making emotional demands; instead, present your case logically.

You might say something like: “Hello, I’ve been reviewing my processing costs and have received a more competitive offer from another provider. I have been a loyal customer and would prefer to stay with your service. I’ve attached my last three statements and the competing proposal. Could you please conduct a rate match credit card processing analysis to see if you can match these terms?”

By providing all the necessary documents, you make it easy for them to review your account and make a counter-offer. This professional approach is more likely to yield a positive result than an aggressive demand. Initiating a rate match credit card processing request this way opens a constructive dialogue.

Analyzing Their Counter-Offer

When your provider returns with a counter-offer, do not accept it at face value. It’s time to put your analytical skills to work.

- Check the Pricing Model: Did they switch you to a transparent Interchange-Plus model as requested? If not, push back and ask for it.

- Verify the Markup: Is their proposed markup (the “plus” part of Interchange-Plus) truly matching or beating the competitor’s offer?

- Run the Numbers: Using a recent statement, manually calculate what your total fees would have been under their new proposed pricing. Compare this to your old fees and the competitor’s proposal. Does it result in real, tangible savings?

- Review All Fees: Go through your fee checklist from the table above. Did they sneak in any new monthly or annual fees to offset the lower rate? The success of your rate match credit card processing effort depends on this level of detail.

- Get It in Writing: Do not accept a verbal agreement. Insist on a formal, written addendum to your contract that clearly outlines the new pricing structure, all associated fees, and confirms that there is no extension to your contract term.

When to Stay and When to Switch

Your decision should be based on the quality and transparency of the counter-offer.

- When to Stay: If your current provider meets the challenge with a transparent, competitive rate match credit card processing offer that is written down and saves you money, staying is often the path of least resistance. You avoid the hassle of setting up a new account, reprogramming equipment, and training staff.

- When to Switch: If your current provider is evasive, refuses to offer an Interchange-Plus quote, tries to confuse you with complex language, or only offers a partial match while adding new fees, it’s a clear sign that their business model relies on keeping their customers in the dark. In this case, you should confidently move forward with the new provider who has already demonstrated transparency and offered a better deal. The short-term inconvenience of switching will be well worth the long-term savings and peace of mind. A failed rate match credit card processing attempt with your current provider is often the best indicator that it’s time for a change.

Common Pitfalls to Avoid in Your Rate Match Quest

Even with the best preparation, there are several common traps that can derail your rate match credit card processing efforts. Being aware of these pitfalls will help you stay on track and avoid costly mistakes.

The “Too Good to Be True” Rate

Be extremely wary of any offer that seems dramatically lower than all others. Some processors use deceptive tactics like:

- Teaser Rates: They offer an incredibly low introductory rate that skyrockets after a few months. Always ask if the proposed rate is permanent and get it in writing.

- Selective Application: The advertised low rate may only apply to a very specific transaction type, like “qualified, swiped debit cards.” All other transactions, which may constitute the bulk of your sales, will be processed at a much higher rate. This is why an Interchange-Plus model is so important; it negates this trick. A proper rate match credit card processing must apply to your entire processing volume.

Ignoring the Fine Print and Contract Terms

The merchant agreement is a legally binding contract. Failing to read it can have severe financial consequences. Before signing anything—even a rate match addendum—you must review the fine print carefully.

Pay special attention to:

- Contract Length: Are you being locked into a new one, two, or three-year term?

- Early Termination Fee (ETF): Is there a penalty for leaving early? How much is it? A high ETF can make you a captive customer, negating any future negotiating power. The best providers offer month-to-month agreements with no cancellation fees.

- Rate Increase Clauses: Does the contract give the processor the right to raise your rates with little or no notice? A great rate match credit card processing deal is worthless if they can unilaterally raise your markup three months later.

Focusing Solely on Rate and Not on Service

While the goal of a rate match credit card processing is to lower your costs, the rate is not the only factor to consider. The quality of the service and support you receive is also critically important.

Imagine your payment system goes down during your busiest day of the year. The few hundred dollars you saved from a rock-bottom rate will feel meaningless if you can’t reach a knowledgeable support person to help you get back online. When evaluating providers, consider:

- Customer Support: Is their support team available 24/7? Are they based in your country? What are their online reviews like?

- Reliability and Security: Does the provider have a strong reputation for uptime and data security?

- Integration and Technology: Does their platform integrate smoothly with your existing POS system or e-commerce software?

Sometimes, paying a slightly higher markup to a top-tier provider with excellent service is a better long-term business decision than chasing the absolute lowest price from an unknown entity.

The Long-Term Value of Understanding Rate Match Credit Card Processing

Securing a better processing rate is not a one-and-done activity. It is an ongoing process of financial management. The skills you develop by learning how to properly execute a rate match credit card processing analysis will serve your business for years to come.

This knowledge empowers you to be a proactive manager of your company’s expenses. Set a calendar reminder to review your processing statements every six to twelve months. Calculate your effective rate and see if it has crept up. The processing industry is dynamic; rates change, and new fees can be introduced.

By staying vigilant, you can ensure you always have the most competitive pricing available. Your understanding of rate match credit card processing transforms you from a passive rate-payer into an informed and empowered business owner who is in full control of this critical aspect of your finances. This is not just about saving money on one bill; it’s about building a more resilient and profitable business for the future. Your mastery of the rate match credit card processing process is a valuable, long-term asset.

Take Control of Your Processing Costs

The world of credit card processing fees doesn’t have to be an expensive mystery. A rate match credit card processing strategy, when executed with knowledge and diligence, is one of the most effective tools a business owner has to reduce overhead and boost the bottom line.

The journey begins with understanding that you are only negotiating the processor’s markup. It requires you to gather your data, calculate your effective rate, and insist on the transparency of an Interchange-Plus pricing model. By carefully analyzing not just the rates but the entire fee structure, contract terms, and equipment costs, you can confidently distinguish a genuinely good deal from a cleverly disguised trap.

Don’t continue to passively accept your monthly processing bill as an unchangeable cost. Use this guide to take action. Analyze your statements, seek out competitive offers, and engage your provider from a position of knowledge. A successful rate match credit card processing negotiation is within your reach, and the savings you secure will go directly back into growing your business.

Frequently Asked Questions (FAQ)

1. Can any business request a rate match for credit card processing?

Yes, virtually any business that accepts credit cards can and should request a rate match. Whether you are a small retail shop or a large e-commerce enterprise, if you have processing history (at least 3-6 months of statements), you have the necessary data to ask your current provider to match a competitor’s offer or to shop for a new provider.

2. What is the single most important document I need for a rate match?

Your most recent merchant processing statements (at least three consecutive months) are the most critical documents. They contain all the data a processor needs to understand your sales volume, transaction types, and current costs, allowing them to perform a detailed cost analysis and present an accurate and competitive rate match credit card processing proposal.

3. Is the lowest rate always the best deal?

No, absolutely not. A low “teaser” rate can be offset by high monthly fees, expensive equipment leases, or a long-term contract with a hefty early termination fee. A truly great deal is one that offers a competitive rate on a transparent pricing model (like Interchange-Plus) combined with minimal monthly fees, no long-term contract, and reliable customer support. A holistic review is essential for any rate match credit card processing evaluation.

4. What is Interchange-Plus pricing and why is it important for rate matching?

Interchange-Plus pricing is a transparent model where the processor passes through the non-negotiable interchange and assessment fees from the card brands directly to you and then adds their own separate, fixed markup. It is crucial for a rate match credit card processing because it allows for a true apples-to-apples comparison of what different processors are actually charging for their services.

5. How often should I review my processing fees and consider a rate match?

It is a good business practice to conduct a thorough review of your credit card processing fees at least once a year. This involves recalculating your effective rate and checking for any new or increased fees on your statements. If you notice a significant cost increase or it has been more than two years, it is a perfect time to seek competitive quotes and initiate a rate match credit card processing review.